As a consumer, insurance is what you pay for but never want to use; as an insurer, you want to protect the interests of your policyholders and facilitate your agents in doing so. In all cases, technology is the bridge to insurer success in serving policyholders better in today’s digital economy. And, given the established nature of insurance as an industry, digital transformation is the key to providing that next-level customer experience.

In this article, we will explore some definitions you need to know, the conversation in your policyholders’ minds, six insurance industry trends, six keys to serving policyholders, and three steps to making the case for digital transformation in your insurance company environment.

Definitions You Need to Know

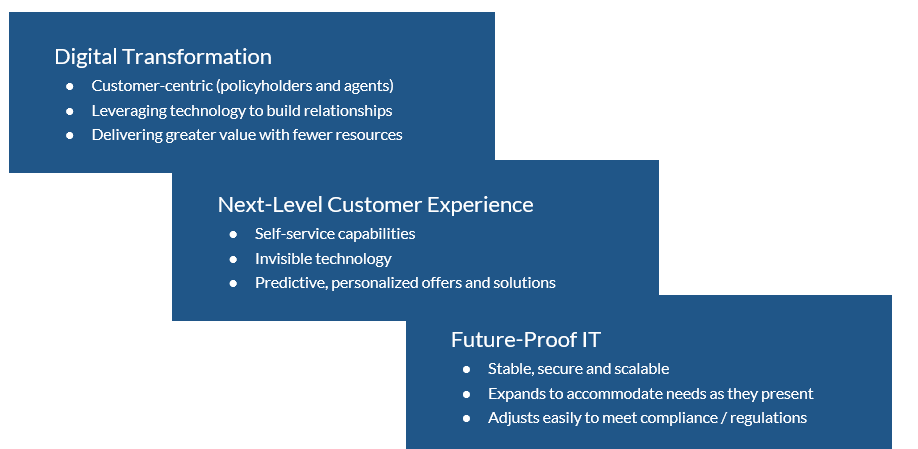

What are we talking about when it comes to digital economy? People expect seamless, fast and invisible technology that they can access on the go. In a sales conversation, they want to do research on their own. In post-transaction service, people want to do as much as they can on their own.

It’s no longer business-as-usual – it’s business as customers drive it. To accommodate this dynamic shift in focus, enterprises today must transform their people, processes and profit centers to be customer-centric, innovative and predictively responsive. In other words, insurers must adopt a process of (digital) transformation to stay ahead of customer (meaning policyholder/agent/stakeholder) demands and remain sustainably competitive in business.

Business is not about the transaction, the ‘deal’ or the ‘close’; instead, it’s about the relationships between customers and the brand, employees and the company. These relationships are fostered by leveraging technology to automate repeatable engagements and determine, then deliver, appropriate personalization through harvesting data. Technology also streamlines the workflows and processes that employees need to support their peak performance and ability to connect with customers and each other.

Future-proof IT (information technology) means your systems are stable, secure and scalable – they will grow with you as your business grows, even if you don’t know what that means. It means preparing in advance for continuous transformation with components that adjust to meet compliance and changing regulations.

For example, XTIVIA just helped one insurer by building a policyholder self-service portal – that reduced call volume significantly. And then we built an agent portal which resulted in 66% more quotes being generated – what used to take an hour now takes less than 10 minutes so agents actually want to use the system. This is an example of all these qualities – it’s digital transformation, wrapping the business workflows and technology around the customer (policyholder and agent), next-level customer experience, invisible tech and future-proof IT in terms of infrastructure.

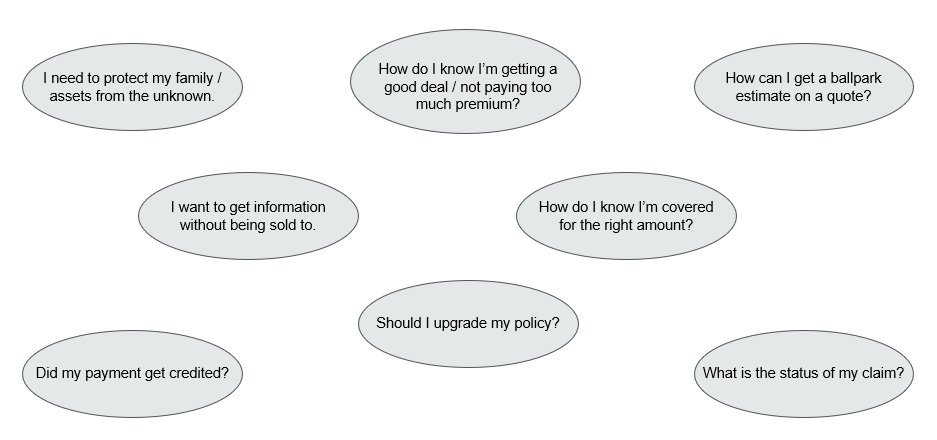

Meet the Conversation in your Policyholder’s Mind

Your customer doesn’t roll out of bed thinking ‘let me ask an agent to check the underwriting status of actuarial tables to determine my premium rate’ – they just want answers to their real-world questions. You must meet the conversation happening in your policyholder’s mind, so they understand, value and access their insurance coverage. Technology helps make that happen when systems are designed properly.

Too often, insurers postpone digital transformation – meaning, solving the difficulty of digitizing and personalizing underwriting policies, managing claims and digitizing quote-to-bind and e-signature process. And yet, that is no longer optional… customers expect instant access to invoices, statements, quotes, service requests and transactions. They don’t want to wait to have a conversation with a customer service representative unless there’s just no way around it.

Insurers must meet the conversation that’s happening in their policyholder’s mind… much of which can be solved through customer-centric digital transformation.

6 Insurance Industry Trends

These trends are not necessarily unique to the insurance industry but will have a significant impact on how insurance as a business is handled. These are disruptions that will determine, ultimately, the competitive edge that an insurer has in the market. It’s about having a strategy to build trust, deliver greater value and engage policyholders with personalized services to simplify their lives.

Following are six insurance industry trends that are affecting the industry, ready or not.

#1: Switching to a ‘digital-first’ business model

Insurance has been a paper-heavy business, given the regulations and need for ‘paper trails’. However, insurers are realizing that digital business is the future – and it is here now. That has led to a focus on digitizing operations and support functions.

#2: Legacy system modernization – including mobile, machine-learning, chatbots, smartphone insurance, virtual claims, drone inspections, etc.

Legacy IT cannot keep up with the demands of a data-intense digital business environment. Even more, new technologies are presenting that will change the way the insurance business is done. Updating IT infrastructure, incorporating new features and functionality and accommodating emerging technologies are now the mandate of IT teams.

#3: All policyholders and agents are now self-service users (access, permissions, experience design, etc.)

In general, consumers rely on digital means to get their information; this trend naturally spills into expectations for the insurance industry to provide the same. Since all users are now self-service users to some degree, there must be systems, protocols and workflows for policyholder and agent access to systems, privacy permissions, having the right experience to match their needs, etc.

#4: Moving IT infrastructure to the cloud for speed, flexibility and scalability

Cloud technologies used to be optional and primarily to reduce costs for resources; now, cloud technology provides more indispensable benefits – speed, flexibility and scalability. When it’s important to deploy new features, provide access to stakeholders from anywhere in the world, meet ‘spike’ demands in service (as in the case of natural disasters), insurers must be prepared by migrating at least some of their systems to the cloud.

#5: Using APIs to solve efficiency issues, data management and automated processing

Where multiple systems are involved, say a back-end accounting system that monitors premium invoicing and payment along with a claims adjusting system and an agent quoting system, those systems may not ‘talk’ to each other. This can cause fragmented information which, ultimately, costs the relationship between the insurer and the policyholder, agent or customer service representative. Using APIs can help your systems talk to each other more efficiently.

#6: Wearable tech means new concerns for underwriters (not just bodily injury but potential software errors, hacking, etc.)

Advances in technology have created wearable tech, which has all kinds of implications – from potential hacking to software glitches to assigning liability in a cross-lines claim due to an accident. Insurers must start adopting protocols to accommodate wearable tech to be ahead of the curve in terms of policyholder behaviors.

Altogether, the questions an insurer needs to ask include whether to buy or build the solutions, how scalable their current software is, assess the expertise of their in-house developer talent and what’s best for their business, their policyholders and their agents.

For example, XTIVIA has helped many insurers leverage technology to facilitate digital transformation, build out solutions that speed their time to market and support user adoption across a number of business use cases. These use cases include: Policyholder Portal, Agent and Broker Portal, Underwriter Portal, Policyholder (or Member) Mobile App, Member Portal, Provider Portal, Employer Portal (aka Group Portal), Customer Service Department Portal, Claims Portal, Digital Workplace Portal, Websites.

Insurers (P & C, life, health, worker’s comp and reinsurance) that set themselves up as digital enterprises can differentiate themselves from, and gain advantage over, their competition by providing an exceptional customer experience to all their stakeholders – policyholders, partners, employees, and agents. Our various business units will handle different aspects of the use cases, and may work across business units to deliver on extensive projects. We have expertise across different aspects of the use cases, from data, APIs and integration to intelligence and user experience to ensure a successful transformation program.

6 Keys to Serving Policyholders Today

Here are six considerations that are part of preparing for successful digital transformation. And, incidentally, digital transformation doesn’t really ‘end’ – it only helps you get to your next level of frictionless operations, future-proof technology and customer-centric solutions and services.

1. Do business departments and the IT work in alignment?

Teams across the company must be not only aligned but responsible for achieving organizational targets together. Each must be, at the very least, familiar with the others’ operations, processes and projects. They should know who works in the team and have connections within other teams as a course of daily business. There needs to be open, consistent communication throughout the company to ensure everyone is pulling toward company goals.

2. Do your employees know that they are a customer service agent first?

In the same line of thought, each and every employee must put customer needs and wants as the priority; meaning, every staff person is a customer service agent, whether or not their role is publicly customer-facing. Customer-centricity is not just a buzzword; instead, it’s the key to the only sustainable business advantage your company has – your brand’s customer experience. Knowing what your customers want, need and expect is the only way you can deliver today and forecast to be ready for their ‘tomorrow’ conversations.

3. Is your company ready to elevate to the cloud?

It’s important that your company be ready to scale resources as needed by working with cloud technologies. Other than security-protected data or apps, just about anything else can be hosted in the cloud for maximum agility, flexibility, scalability and cost-savings. Reduce your organization’s digital footprint by using (and paying for) only the resources you need.

4. Are your employees able to work and collaborate through digital workspaces yet?

With a digital economy, your employees and your customers need to be able to work from anywhere, anytime, from any device, supported by a secure and flexible infrastructure. It is this point that may have started the idea of ‘digitizing’ a business which, over time, became digital transformation. Ideally, your documents, apps, intranets and more will be cloud-based, or digitally available, to enhance employee (and customer) engagement.

5. Will your employees be open to adopting cross-functional team communication, workflows and projects?

Digital transformation breaks down silos, whether they are based in technology, performance or corporate culture. Your employees need to be able to adapt with change and be willing to pivot as you learn from data, procedural insights, customer trends and input, and even the digital transformation process itself.

6. Do your business leaders have the skills to create a digital transformation strategy for your company?

In many organizations, leaders lack the cross-functional skills needed to take into consideration aspects of next-level strategic planning to ensure your company stays relevant, competitive and valuable to your customer market. That can leave a gap that will slow, stall or even stop parts of the digital transformation process. You may need to hire or consult with people who have the right skills to put the right framework(s), strategy(s) and team(s) together to achieve your transformation goals. And you will likely need to invest in your employees to ensure they stay on their growing edge for the benefit of your company.

These are how you operationalize transformation to serve your policyholders in today’s digital economy.

3 Steps to Making the Case for Digital Transformation

There are three major steps to making the case for digital transformation for next-gen policyholder (and agent) experience.

1. Vision the Possibilities

See how your policyholders are served in the ideal scenario. You may want to consider examples from other industries (or competitors) to determine your vision.

2. Assess the Now

Look at the current IT, workflows, processes and policyholder / agent experience; consider gaps, hiccups, issues, capabilities to see the areas and priorities for upgrade.

3. Create the Plan

Prioritize the areas that need to be addressed to reach the vision; prioritize actions and investments. Allow for milestone achievement. Then operationalize the plan.

What Does It All Mean?

Insurance protects life in today’s modern world. The right technology protects insurers from becoming obsolete.

Dennis Robinson, Chief Executive Officer, XTIVIA

For most companies today, digital transformation is merely about digitizing, streamlining, stabilizing and cleaning shop on where they are today to simply be current with today’s needs and best practices.

However, innovation and the competition are factors that invite action now. Insurers have very little ‘wiggle room’ when it comes to making the needed investments of time, energy and funds to optimize their infrastructure and ensure policyholder-centricity on every level.

You can jumpstart the process by hiring a trusted partner who specializes in various aspects of digital transformation – from discovery and assessment to planning and training to technology and implementation. And yes, this is a shameless plug for you to have a chat with one of XTIVIA’s trusted advisors because we can help. Or ping me – let’s talk strategy! I’d love to hear what you’re up to!

You cannot afford to wait until conditions are perfect to initiate digital transformation. You cannot ‘do’ digital transformation like everybody else does it because there is no one-size-fits-all here – your organization is unique in how you got where you are and where you want to go in your future. And you can’t afford the luxury of not knowing what you don’t know about digital transformation.

The good news is that XTIVIA has your back. I just looked and learned XTIVIA has had something like 370 engagements with insurers since 2016. Anyway, like everything else we do, we will state with complete transparency (and no obligation) that we want to learn about you and your organization to see how we can simplify your digital transformation process.

Let your customers drive your business. Respond by being ready for implementing digital transformation so you can deliver increasingly targeted value to your customers. Enjoy the rewards of long-term relationships – and next-level policyholder (and agent) success.